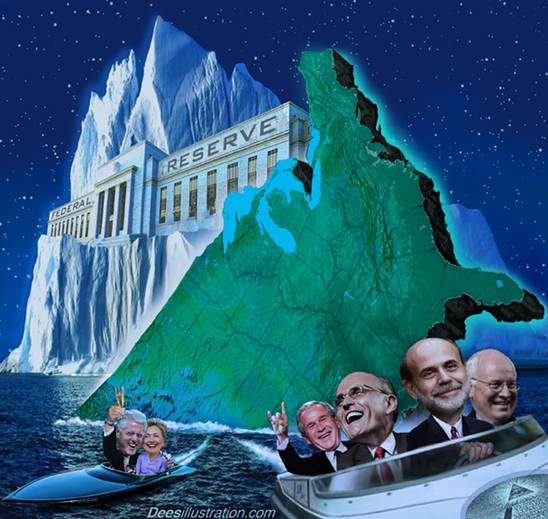

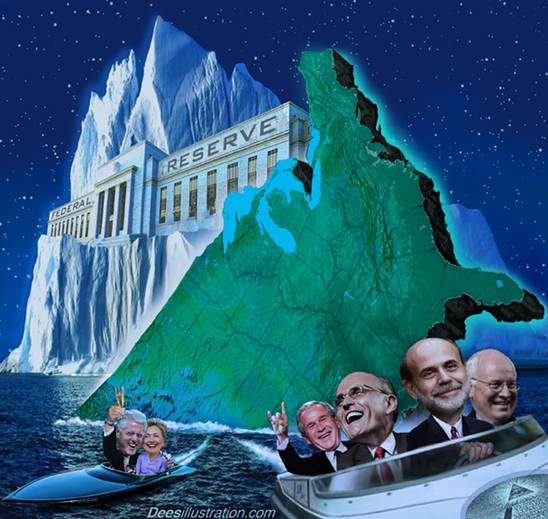

Radical bailout plan has a jawdropping price tag

WASHINGTON - Struggling to stave off financial catastrophe, the Bush administration on Friday laid out a radical bailout plan with a jawdropping price tag — a takeover of a half-trillion dollars or more in worthless mortgages and other bad debt held by tottering institutions.

Relieved investors sent stocks soaring on Wall Street and around the globe. The Dow-Jones industrials average rose 368 points after surging 410 points the day before on rumors the federal action was afoot.

A grim-faced President Bush acknowledged risks to taxpayers in what would be the most sweeping government intervention to rescue failing financial institutions since the Great Depression. But he declared, "The risk of not acting would be far higher."

The administration is asking Congress for far-reaching new powers to take over troubled mortgages from banks and other companies, including purchasing sour mortgage-backed securities. Administration officials and congressional leaders are to work out details over the weekend.

Congressional officials said they expected a request for legal authority to buy up the bad loans, at a cost in excess of $500 billion to the government. Democrats were discussing whether to try to attach middle class assistance to the legislation, despite a request from Bush to avoid adding controversial items that could delay action. An expansion of jobless benefits was one possibility.

In other major steps, the Treasury Department and Federal Reserve moved to give money-market mutual funds the same kind of federal protection, at least temporarily, that now applies to savings and checking accounts and certificates of deposit at banks. Money-market accounts sold through retail banks are already FDIC insured.

The spreading global selling panic had started to threaten some money-market funds, usually thought of as rock-solid investments. Administration officials feared a run on these funds, held by millions of Americans.

"Every American should know that the federal government continues to enforce laws and regulations protecting your money," Bush said at the White House. The 75-year-old Federal Deposit Insurance Corporation now insures savings and checking accounts and certificates of deposit up to $100,000.

Separately, the Securities and Exchange Commission acted to block short-selling in financial securities. That is a trading method that bets the value of stocks will go down. It has been blamed for accelerating the plunge in stock prices of banks and other financial institutions.

"This is a pivotal moment for America's economy," Bush said. "In our nation's history, there have been moments that require us to come together across party lines to address major challenges. This is such a moment."

Congressional leaders of both parties welcomed the administration's bold moves, after a series of ad hoc rescues.

The talk on the presidential campaign trail, barely six weeks before the election, was of bipartisanship, too.

Democrat Barack Obama said it was critical that leaders in both parties work in concert. "Truly, we are all in this together," he said.

GOP presidential nominee John McCain said leaders should put aside partisan differences and "any action should be designed to keep people in their homes and safeguard the life savings of all Americans."

The federal government already has pledged more than $600 billion in the past year to bail out, or help bail out, some of the biggest names in American finance. That includes the rescue of investment bank Bear Stearns in March, the takeover of mortgage giants Fannie Mae and Freddie Mac earlier this month and the takeover of the world's largest insurance company, American International Group, just this week.

But the contagion continued to spread, bringing political consensus that drastic and comprehensive federal action was needed.

There are precedents for such a federal takeover.

In the late 1980s, the government created the Resolution Trust Corporation to tackle the savings and loan crisis. It acquired the defaulted mortgages, foreclosed real estate and other assets of nearly a thousand failed S&Ls, restoring order and stability to the system. Resolving that crisis took six years and $125 billion in taxpayer money — roughly equal to $200 billion in today's dollars.

And there was the Reconstruction Finance Corporation, a Depression-era relief program formed in 1932 by President Hoover that tried to revive the market by giving loans to banks and other businesses.

On Friday, Treasury Secretary Henry Paulson gave few details about the structure of the new program. Asked about an overall price tag, he said, "hundreds of billions" of dollars.

Congressional leaders said they were ready to move quickly but still needed details of the administration plan. For instance, there was no indication of what the government would get in return from financial companies for the federal assistance.

Paulson and Federal Reserve Chairman Ben Bernanke briefed lawmakers in both parties on the idea by conference call Friday.

In a session with House Democrats, they described a plan where the government would in essence set up reverse auctions, putting up money for a class of distressed assets — such as loans that are delinquent but not in default — and financial institutions would compete for how little they would accept for the investments, said Rep. Brad Sherman, D-Calif., who participated in the call.

"You give them good cash; they give you the worst of the worst," Sherman said of the plan, which he complained that Bush and his economic advisers were trying to panic lawmakers into rubber-stamping.

Paulson rejected Democrats' calls to include tighter regulations, corporate reforms or limits on executive compensation as part of the measure, Sherman said. "He's doing his best to paint a picture of the sky falling, and then he says, because the sky's falling, you have to do it my way."

Paulson said the new troubled-asset relief program that he wants Congress to enact must be large enough to have the necessary impact while protecting taxpayers as much as possible.

"I am convinced that this bold approach will cost American families far less than the alternative — a continuing series of financial institution failures and frozen credit markets unable to fund economic expansion," Paulson. "The financial security of all Americans ... depends on our ability to restore our financial institutions to a sound footing."

Bush said simply, "We must act now."

"America's economy is facing unprecedented challenges. We're responding with unprecedented measures," Bush declared, standing in the White House Rose Garden with Paulson, Bernanke and Christopher Cox, chairman of the Securities and Exchange Commission.

Shortly after his remarks, Bush called congressional leaders with whom the administration will be working on the final plan. He spoke to Senate Majority Leader Harry Reid, D-Nev., House Speaker Nancy Pelosi, D-Calif., Senate Republican leader Mitch McConnell of Kentucky and House GOP leader John Boehner of Ohio.

The administration wants to see a package emerge from the weekend, to lend calm to Monday morning's market openings, said Keith Hennessey, the director of the president's economic council. The goal is to have something passed by Congress by the end of next week, when lawmakers recess for the elections.

Paulson said Fannie Mae and Freddie Mac will step up their purchases of mortgage-backed securities to help provide support to the crippled housing market. He also said the Treasury Department will expand a program, announced earlier this month, to buy mortgage-backed securities, which have been badly hurt by the housing and credit crises.

"As we all know, lax lending practices earlier this decade led to irresponsible lending and irresponsible borrowing. This simply put too many families into mortgages they could not afford," Paulson said.

Bush authorized Treasury to tap up to $50 billion from a Depression-era fund to insure the holdings of eligible money-market mutual funds. And the Federal Reserve announced it would expand its emergency lending program to help support the $3.4 trillion in total assets of the funds.

On Wednesday alone, investors had pulled more than $89 billion from money-market funds, according to iMoneyNet, publisher of the newsletter Money Fund Report.

The government's actions could help alleviate the uncertainty that has been sending the markets into tumult over the past week. Lending has come to a virtual standstill in the wake of the bankruptcy of Lehman Brothers Holdings Inc.

European Central Bank, Swiss National Bank and Bank of England also offered up more cash Friday. The three banks put a combined $90 billion into money markets.

---

America's Surprising Foreclosure Hot Spots

The crisis on Wall Street is shrinking net worths and erasing nest eggs. Next on the block: multimillion-dollar homes.

In some of America's wealthiest spots, that's already happening. According to RealtyTrac, an Irvine, Calif.-based listing firm that tracks foreclosures and provided the data here, several of the country's wealthiest ZIP codes--where year-to-date median home sales are above $700,000--have reported foreclosures into the triple digits. They include La Jolla, Calif.; Miami Beach; and Carlsbad, Calif.

In Carlsbad, for example, there are 302 homes in foreclosure. The wealthy beach town--the median home sale price is $710,000--has suffered from overvaluation and risky financing, says Rick Sharga, a senior vice president at RealtyTrac. The only thing that separates homeowners in Carlsbad from those in spots like St. George, Utah, with 274 current foreclosures and a median home price of $218,000, and Ann Arbor, Mich., with 436 current foreclosures and a median home price sale of $225,000, is that in Carlsbad folks are losing their second homes.

In Pictures: America's Surprising Foreclosure Hotspots

"In this real estate cycle, no ZIP code, no neighborhood, was immune," says Sharga. Not only are average Americans defaulting on subprime loans, wealthier individuals who were relying on bonuses that never came through or who took out option adjustable-rate mortgages and must now face the skyrocketing monthly rates have also had to flee.

Take Lake Forest, Ill., a Midwestern town with a love for--of all things--polo. (The local country club hosts matches every weekend in August.) The fondness for the upper-echelon game is a tip-off that the brunt of Lake Forest residents aren't suffering financially. Still, many of the community's properties are vacation homes, which means that those who secured a second mortgage even though it was beyond their means are now defaulting. While the median house sale price is $873,750, the current number of foreclosures is 53.

Overvaluation is another major factor in high-end foreclosures, says Sharga. During the housing boom of the mid-aughts, buyers paid prices for homes with a huge expected appreciation cooked into the price. As prices corrected, many were saddled with mortgages, with monthly payments reflecting the former value of the home.

Speculative activity, or people betting pricey homes will always have ready buyers, is another factor. "People were leveraging the equity in their homes to speculate on other properties," says Sharga.

That's the case in Malibu, Calif., and other California spots, including Newport Beach and La Jolla. The median home sale price in Newport Beach is $1.4 million and there are 89 homes in foreclosure; in La Jolla, there are 158 foreclosures, due mostly to second-home buyers overextending themselves.

It's not just vacation towns in California taking a hit. Foreclosures have been more prevalent since the credit crunch has caused those in the New York and Philadelphia metro areas who could once afford a vacation home to default as well. On the southern part of New Jersey's Long Beach Island, Beach Haven boasts a median house sale of $722,500.

In other areas, buyers took out loans for properties that were beyond reach. This happened in Scarsdale, N.Y., just 30 minutes from Manhattan's Grand Central Terminal. This pleasant commuter town, whose Tudor-style buildings evoke an English village, currently has 57 foreclosures.

Another problem is overabundance of property. The affluent area of Scottsdale, Ariz.--a popular spot for retired snowbirds--has been affected by overbuilding in the condominium sector. That means values have dropped and speculators have no one to sell to. "Typically, when we see an abnormal surge in an otherwise stable area, homes are being overbuilt," says Sharga.

Whether because of overbuilding, overvaluation or risky financing, the current foreclosure dilemma suggests one thing: No one is truly "comfortable" right now when it comes to finances.